By Harriet Forster June 18, 2025

In today’s digital age, accepting credit cards over the phone has become an essential part of running a successful business. Whether you operate a small business or a large corporation, providing customers with the convenience of making payments over the phone can significantly enhance their overall experience. However, it is crucial to understand the basics of accepting credit cards over the phone to ensure a seamless and secure transaction process.

To accept credit cards over the phone, you need to collecting payment information from customers and processing the transaction manually. This method allows businesses to accept payments without the need for a physical card or an in-person transaction. By accepting credit cards over the phone, businesses can expand their customer base and cater to individuals who prefer making purchases remotely.

Setting Up Your Business to Accept Credit Cards Over the Phone

Before you can start accepting credit cards over the phone, you need to set up your business to facilitate this payment method. Here are some essential steps to follow:

1. Obtain a merchant account: To accept credit card payments, you need to establish a merchant account with a payment processor. This account will enable you to process credit card transactions and receive funds in your business bank account.

2. Choose a payment gateway: A payment gateway acts as a bridge between your business, the customer, and the payment processor. It securely transmits payment information and ensures that transactions are processed smoothly.

3. Acquire a virtual terminal: A virtual terminal is a web-based application that allows you to manually enter credit card information and process payments over the phone. It provides a user-friendly interface for inputting customer details and initiating transactions.

4. Train your staff: It is essential to train your staff on how to handle credit card transactions over the phone. They should be familiar with the virtual terminal, understand security protocols, and be able to assist customers effectively.

Choosing the Right Payment Processor for Phone Transactions

Selecting the right payment processor is crucial for smooth and secure credit card transactions over the phone. Here are some factors to consider when choosing a payment processor:

1. Security: Look for a payment processor that prioritizes security and offers robust encryption and fraud prevention measures. This ensures that customer data is protected during the transaction process.

2. Compatibility: Ensure that the payment processor you choose is compatible with your virtual terminal and other systems you use for your business operations. Seamless integration between systems will streamline the payment process.

3. Pricing: Compare pricing structures and fees offered by different payment processors. Look for transparent pricing models that align with your business’s needs and budget.

4. Customer support: Consider the level of customer support provided by the payment processor. Responsive and knowledgeable support can be invaluable in resolving any issues that may arise during credit card transactions.

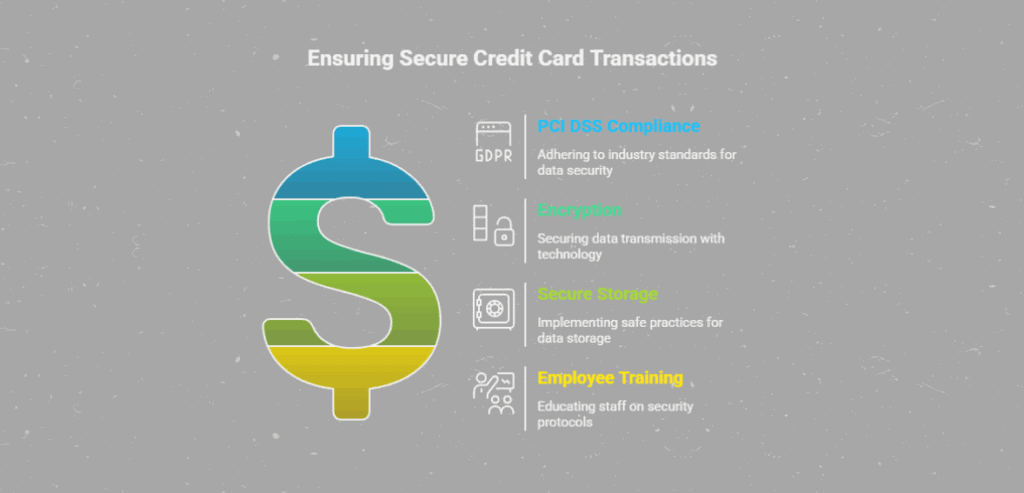

Ensuring Security and Compliance in Phone Credit Card Transactions

Security and compliance are paramount when accepting credit cards over the phone. Here are some measures to ensure the safety of customer data and compliance with industry regulations:

1. PCI DSS compliance: The Payment Card Industry Data Security Standard (PCI DSS) sets guidelines for securely handling credit card information. Ensure that your business is compliant with these standards to protect customer data.

2. Encryption: Use encryption technology to secure credit card information during transmission. This ensures that sensitive data cannot be intercepted or accessed by unauthorized individuals.

3. Secure storage: Implement secure storage practices for customer data. Avoid storing credit card information unless necessary, and if you do, ensure it is stored in a secure and encrypted manner.

4. Employee training: Train your employees on security protocols and best practices for handling credit card information. This includes educating them on the importance of not sharing customer data and regularly updating passwords.

Step-by-Step Guide: How to Accept Credit Cards Over the Phone

Accepting credit cards over the phone involves a step-by-step process to ensure a smooth transaction. Here is a guide on how to accept credit cards over the phone:

1. Gather customer information: Collect the necessary information from the customer, including their name, billing address, credit card number, expiration date, and CVV code.

2. Verify customer details: Confirm the accuracy of the information provided by the customer, including their billing address and contact details.

3. Enter information into the virtual terminal: Use the virtual terminal to enter the customer’s credit card information. Ensure that you input the details accurately to avoid any processing errors.

4. Process the transaction: Initiate the transaction through the virtual terminal. The payment processor will securely transmit the information to the customer’s bank for authorization.

5. Obtain authorization: Wait for the payment processor to receive authorization from the customer’s bank. This typically takes a few seconds, and the result will be displayed on the virtual terminal.

6. Provide confirmation to the customer: Once the transaction is authorized, provide the customer with a confirmation number or receipt to acknowledge the successful payment.

Best Practices for Efficient and Effective Phone Credit Card Processing

To ensure efficient and effective phone credit card processing, consider implementing the following best practices:

1. Streamline the process: Simplify the steps involved in accepting credit cards over the phone to minimize customer effort and reduce the chances of errors.

2. Offer multiple payment options: Provide customers with various payment options, such as credit cards, debit cards, and digital wallets. This allows them to choose the method that is most convenient for them.

3. Train your staff: Continuously train your staff on best practices for phone credit card processing. This includes effective communication, data security, and handling customer inquiries or concerns.

4. Maintain accurate records: Keep detailed records of all phone credit card transactions, including customer information, transaction amounts, and dates. This helps with reconciliation and provides a reference in case of any disputes.

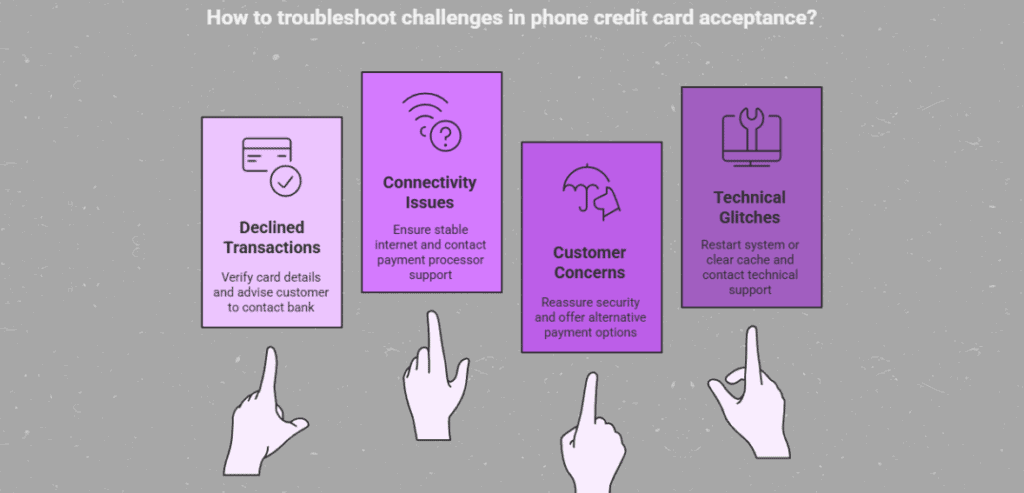

Common Challenges and Troubleshooting Tips for Phone Credit Card Acceptance

While accepting credit cards over the phone offers convenience, there can be challenges that arise during the process. Here are some common challenges and troubleshooting tips:

1. Declined transactions: If a transaction is declined, double-check the credit card information entered for accuracy. If the problem persists, advise the customer to contact their bank for further assistance.

2. Connectivity issues: In case of connectivity issues with the virtual terminal, ensure that you have a stable internet connection. If the problem persists, contact your payment processor’s support team for assistance.

3. Customer concerns: Address any customer concerns promptly and professionally. If a customer is hesitant to provide credit card information over the phone, reassure them of the security measures in place and offer alternative payment options if available.

4. Technical glitches: If you encounter any technical glitches with the virtual terminal or payment processor, try restarting the system or clearing cache and cookies. If the issue persists, contact technical support for guidance.

Frequently Asked Questions (FAQs) about Accepting Credit Cards Over the Phone

1. Is it safe to accept credit cards over the phone?

Yes, it is safe to accept credit cards over the phone if you follow security protocols and comply with industry standards such as PCI DSS. Implementing encryption technology and secure storage practices ensures the protection of customer data.

2. Can I accept credit cards over the phone without a merchant account?

No, you need a merchant account to accept credit cards over the phone. A merchant account enables you to process credit card transactions and receive funds in your business bank account.

3. What information do I need to collect from customers to accept credit cards over the phone?

To accept credit cards over the phone, you need to collect the customer’s name, billing address, credit card number, expiration date, and CVV code. This information is necessary to process the transaction securely.

4. Can I accept credit cards over the phone using a mobile device?

Yes, you can accept credit cards over the phone using a mobile device by utilizing a mobile payment processing app. These apps allow you to securely process credit card transactions on the go.

Conclusion

Accepting credit cards over the phone is a valuable payment method that can enhance customer convenience and expand your business’s reach. By understanding the basics of accepting credit cards over the phone, setting up your business correctly, choosing the right payment processor, and ensuring security and compliance, you can provide a seamless and secure transaction experience for your customers.

By following best practices, troubleshooting common challenges, and addressing customer concerns, you can optimize your phone credit card acceptance process and contribute to the overall success of your business.